Contents:

Measure the distance between the start of the trend and the consolidation. The pattern can be applied to the Forex market, stock, cryptocurrencies, commodities, etc. But spotting the trend when it is in the nascent stage is challenging, and running along with it right up to the top is an even bigger challenge.

Could Gold Eventually Fall to $1790/80? – Investing.com

Could Gold Eventually Fall to $1790/80?.

Posted: Thu, 09 Feb 2023 08:00:00 GMT [source]

Waiting for a candlestick to close outside of the flag tends to add credence to the breakout, and can help the trader mitigate risk. The length of the exit line from a downward consolidation phase is proportionate to the length of the flagpole. If the price has gone up far, don’t expect a pullback to the support level.

How to Trade a Bull Flag Pattern?

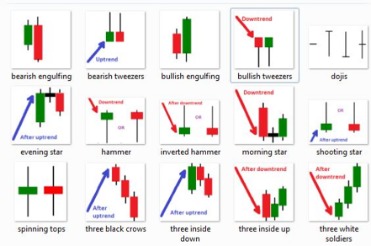

Here are some steps to help you determine the bull flag pattern. A trader should be careful when defining the bull flag candlestick pattern. The price corrected for three weeks during the strong uptrend but continued its upward movement later. The Cup and Handle chart pattern helps you quite accurately anticipate pullbacks and trade according to the main rule of technical analysis, “Trend is your friend, trade with the trend”. A stop-loss level could be defined by the risk-reward ratio.

- By contrast, a bearish volume pattern increases first and then tends to hold level since bearish trends tend to increase in volume as time progresses.

- The Cup and Handle chart pattern helps you quite accurately anticipate pullbacks and trade according to the main rule of technical analysis, “Trend is your friend, trade with the trend”.

- The reason for this is that bearish, downward trending price moves are usually driven by investor fear and anxiety over falling prices.

- The flags appear in an uptrend or a downtrend as a short period of consolidation followed by a breakout and then a continuation of the trend.

- These patterns allow traders to enter trendy markets, anticipate price changes, and trade with less risk.

The descending triangle is a https://g-markets.net/ pattern used in technical analysis. The pattern usually forms at the end of a downtrend but can also occur as a consolidation in an uptrend. The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders. At a minimum, these studies indicate at least 50% of aspiring day traders will not be profitable.

Bear flag vs Bear pennant

To get fib bear flag vs bull flag level targets, first plot the high to low and low back to high price levels of the flagpole. This should not only give the fib retracement levels but also the fib extension levels. There are three potential price target levels indicated by 1.27, 1.414 and 1.618 fib extensions, which each double as a potential price reversal zone .

Top Crypto Analyst Issues Ethereum Warning, Says ETH Price … – The Daily Hodl

Top Crypto Analyst Issues Ethereum Warning, Says ETH Price ….

Posted: Sun, 05 Mar 2023 23:05:23 GMT [source]

In the end, the price should break above the upper boundary of the pattern. If the retracement is below 50%, it’s not a flag pattern. The retracement shouldn’t be lower than 38% of the trend. When it comes to making big money in trading, the trend is your friend. Also, with this strategy, you don’t have to track the price dynamics. After the retracement, we are waiting for the breakout of the upper border of the formed rectangle.

Chart Patterns Bull and Bear Flags

However, it is worth noting that the longer the consolidation phase lasts, the less reliable the pattern becomes. Therefore, it is best to enter trades when the consolidation phase is relatively short. Thus these moves are characterized by higher than average volume patterns.

Once early bears realize the strength in the overall move, they give up their early shorting efforts. On the contrary, technical analysis disregards the EMH and is only interested in the price and volume behavior of the market as a basis for price prediction. A technical analysis pattern called the bull flag is a recognized price pattern and is thought to indicate that a price increase is about to occur.

How to identify the bull flag chart pattern

Hence, the bull flag facilitates a trade after the flag is broken to the upside. The breakout equips us with precisely defined levels to play with. Following the creation of a short-term peak, the price action starts a correction to the downside. The break of the flag, which occurs in the third stage of the bull flag pattern, offers the optimal entry signal. The previous swing high will serve as the initial profit objective for the bullish flag pattern, and the consolidation structure might serve as the stop-loss level.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

The other way is to use the 20-day moving average as a stop. So if prices close below that moving average then you would close out your position. The main thing to look for in this pattern is volume. Volume confirms major moves and the likely hood that a breakout will be successful. All investing involves risk, including loss of principal invested. Past performance of a security or strategy does not guarantee future results or success.

Draw an upper trend line to define the upper bounds of the flag. Funded trader program Become a funded trader and get up to $2.5M of our real capital to trade with. Join thousands of traders who choose a mobile-first broker. Harness past market data to forecast price direction and anticipate market moves. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position.

When the lower trendline breaks, it triggers panic sellers as the downtrend resumes another leg down. Just like the bull flag, the severity of the drop on the flagpole determines how strong the bear flag can be. Day traders may make their entry just several candles after for shorter-term trades, though this comes at a much higher risk of entering on the basis of a false signal. It’s critical to understand that just because flags are continuation patterns, that doesn’t mean you should enter a trade immediately after you identify one.

T-bills are subject to price change and availability – yield is subject to change. Past performance is not indicative of future performance. Investments in T-bills involve a variety of risks, including credit risk, interest rate risk, and liquidity risk. As a general rule, the price of a T-bills moves inversely to changes in interest rates.