As true with most of the technical indicators, MACD also finds its period settings from the old days when technical analysis used to be mainly based on the daily charts. The reason was the lack of the modern trading platforms which show the changing prices every moment. As the working week used to be 6-days, the period settings of represent 2 weeks, 1 month and one and a half week. Now when the trading weeks have only 5 days, possibilities of changing the period settings cannot be overruled. The Moving Average Convergence-Divergence indicator , or ‘Mac D’ as it is usually referred to, was devised by Gerald Appel a US investment manager in 1977.

Still, it’s an effective indicator when used in the right context. Experiment with the MACD and decide for yourself if any of its signals fit your trading approach. Like every other indicator, you can’t rely on it for “surefire” signals, but you can rely on it as an objective, albeit mechanical. Despite MACD’s obvious attributes, just like with any indicator, the trader or analyst needs to exercise caution.

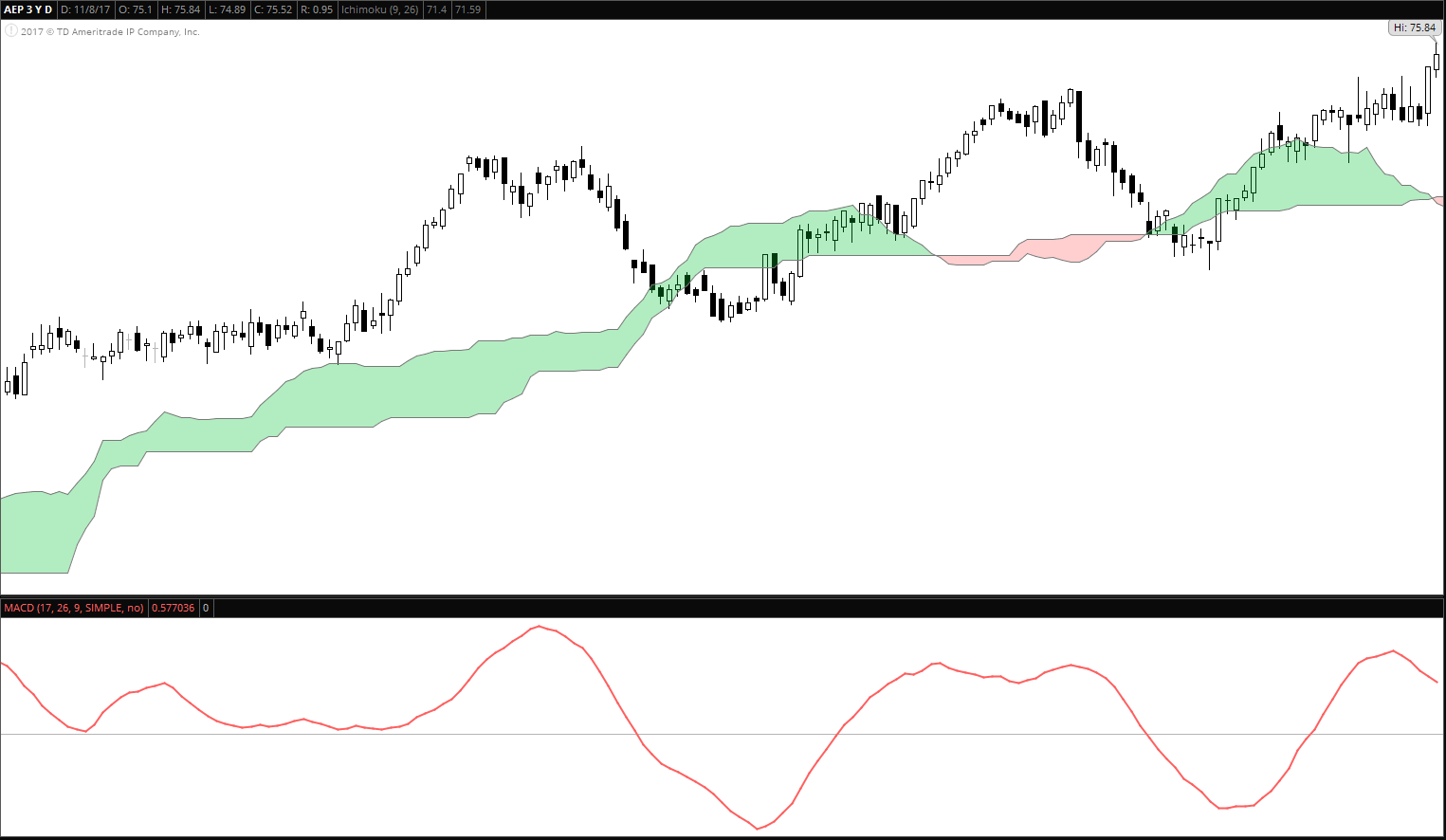

This bearish divergence warned of the impending downturn of the S&P 500 future and the market as a whole. The MACD indicator, also known as the MACD oscillator, is one of the most popular technical analysis tools. On the other hand, when a new high forms on the price but a lower high forms on the MACD, it is a sell signal. In both cases, it is also good to watch the long-term trend, as divergence signals act more as a confirmation of a longer trend, not as an indicator of a trend change. Although MACD is a powerful indicator that can be used to gain insight into the market and make trading and investment decisions, it is not self-sufficient just like the others.

Divergence occurs when the price trend and the indicator move in opposite directions, this suggests that the price trend could be weakening. Plotted around a zero line, a positive MACD indicates that average prices over the past 12 days are higher than average prices over the past 26 days and so signal a bullish market . However, using crosses above and below the zero line is a crude and ineffective method of generating trading signals. The moving average convergence divergence index was invented by Gerald Appel in the 1970s. Appel designed the MACD as a technical analysis tool to gain insight on stock prices, with the intent to reveal data about the stock’s momentum, strength, as well as directional assumptions. And, as they say in the disclaimers, past performance does not guarantee future results.

The Klinger Oscillator is a technical indicator that combines prices movements with volume. The indicator uses divergence and crossovers to generate trade signals. The Kairi Relative Index is a technical analysis indicator used to indicate potential buy and sell points based on overbought or oversold conditions.

Markets

This technique can effectively identify the resumption of a trend when the MACD does not cross 0. The distance between the MACD and the MACDA is the basis of the Oscillator Less MA of Oscillator study. The MACD indicator is so widely used by traders owing to both its simplicity and reliability . One reason the indicator is so popular is due to the fact that it provides signals indicating both the strength of the trend and when the trend is running out of steam . Knowing how strong the indicator signals are and the direction of a trend is a valuable asset to traders. The MACD indicator was invented in the 1970s by professional money manager Gerald Appel.

Zoom Video’s Charts Are in Focus, but You Might Not Like What You … – RealMoney

Zoom Video’s Charts Are in Focus, but You Might Not Like What You ….

Posted: Tue, 28 Feb 2023 16:43:11 GMT [source]

Similarly, it is bullish when the price touches a new high, but the MACD does not follow it and makes a new high. One of the primary problems with MACD divergence is that it can frequently signal a possible reversal, but no actual reversal occurs, meaning it produces a false positive. Ultimately, it seems to predict too many reversals that don’t occur and not an adequate amount of actual price reversals. Useful as a stand-alone tool or in tandem with other technical indicators. Another potential downside is that the MACD is a trend following indicator. This means that the indicator gives its signals as the trend occurs, not before it starts.

How to Read MACD 📋

In addition, pay attention to divergence/convergence between the indicator and the price. Bullish convergence is formed, when the price sets lower lows, while the minimums of the MACD histogram get higher . Bearish divergence is formed, when the price renews highs, while the MACD maximums become lower .

Can Goldman Sachs Get Its Swagger Back? – RealMoney

Can Goldman Sachs Get Its Swagger Back?.

Posted: Tue, 28 Feb 2023 18:39:34 GMT [source]

To avoid unreliable https://traderoom.info/s, use MACD with momentum indicators and price actions to guide your trading decisions. Like most other technical analysis tools, the MACD indicator also comes with its own distinct advantages and disadvantages. To fully harness this momentum and trend indicator to its maximum capability, it’s essential to understand where it triumphs and where it can fall short.

For example, the MACD is more sensitive and might be better suited for weekly charts. The MACD is a simple and effective trend following tool, with the CQG defaults the most common variables used in the market. Moving Average Convergence and Divergence was proposed as a trend-following momentum indicator by Geral Appel in 1979.

Trading

12 or the shorter period is known as the faster average while 26 is known as the slow average. This is because the faster-moving average is usually more reactive to price changes and vice versa. The MACD indicator measures the convergence and divergence of two moving averages. The mid-term moving average is subtracted from the short-term moving averages to arrive at this value.

This signal indicates a correction within a longer trend and can serve traders as a useful tool for confirming the trend and entering additional positions after corrections. In this article, we will examine what the MACD is, what it is used for, the advantages and disadvantages of using it among many other things. We will also try to compare it to similar other indicators and also talk about how relevant it is in doing technical analysis.

How to use the MACD indicator?

Convergence occurs when the moving averages move towards each other. Divergence takes place when the moving averages move away from each other. The MACD histogram is above 0 when the 12-period MA is above the 26-period MA and below 0 when the shorter MA is below the longer MA. As a result, positive values of the histogram point at a bullish trend, while negative values mean a downtrend. Gerald Appel defined the MACD with its default parameter values.

Note that the histogram bars have nothing to do with the trading volume of the asset. Assuming the standard time ranges, the MACD line itself is calculated by subtracting the 26-day EMA from the 12-day EMA. It’s important to recognize whether a market is moving directionally or sideways.

The MACD Linewhich represents the difference between two moving averages. From the chart above, you can see that the fast line crossed UNDERthe slow line and correctly identified a new downtrend. When a new trend occurs, the faster line will react first and eventually cross the slower line .

The MACD is a very important indicator for determining when to buy or sell an asset. It gives the user an advantage as it tells them when to buy and when to sell their asset of interest. With the histograms, technical analysts can also tell how strong a trend is to help them make the right decisions. Technical analysis requires the use of tools known as technical indicators. There are many of them out there, but technical analysts use some more often than they do others. One of the most important of the indicators is the Moving Average Convergence Divergence .

The histogram is made of a bar graph, making it visually easier to read and interpret. While 12, 26, and 9 are the typical value settings used with the MACD, traders can opt for other values depending on their trading style and goals. A MACD crossover of the signal line indicates that the direction of the acceleration is changing.

Notice in this example how closely the tops and bottoms of the MACD histogram are to the tops of the Nasdaq 100 e-mini future price action. When a stock, future, or currency pair is moving strongly in a direction, the MACD histogram will increase in height. This occurs because the MACD is accelerating faster in the direction of the prevailing market trend. Similarly, when the MACD crosses below the MACD Signal Line a possible sell signal is generated. When the MACD crosses below the zero line, then a possible sell signal is generated.

Furthermore, you can anticipate the reliability of your buy and sell signals based on the distance between the crossovers and the histogram’s zero line. A “zero crossover” event occurs when the MACD series changes sign, that is, the MACD line crosses the horizontal zero axis. This happens when there is no difference between the fast and slow EMAs of the price series.

- In addition, there is the MACD histogram, which is calculated based on the differences between those two lines.

- The Moving average convergence divergence concept is a technical analysis indicator for analyzing the stock market.

- One of the divergence problems is that it can signal a reversal, but it is a false positive.

- Users of the MACD generally avoid trading in this situation or close positions to reduce volatility within the portfolio.

- This oscillator is an attractive way to view hidden price divergence…

The https://forexhero.info/ indicator shows the difference between two exponential moving averages; thus it is calculated by subtracting the 26 period exponential moving average from the 12 period EMA. Additionally, a 9-period EMA of the MACD itself is formed as a signal line. When the shorter-term 12-period exponential moving average crosses over the longer-term 26-period EMA a potential buy signal is generated. Suppose Dan wants to invest in the stock market and analyze recorded data points regarding MACD.

A https://forexdelta.net/ signal, on the other hand, can be seen when it moves below the neutral point. Some MA convergence/divegence indicators usually come with a histogram. This histogram is usually the difference between the MACD line and the signal line. In this case, the type of moving average that is used is the exponential average.

In Appel’s Histogram the height of the bar corresponds to the MACD value for a particular point in time. Thomas Asprey dubbed the difference between the MACD and its signal line the “divergence” series. Gerald Appel referred to a “divergence” as the situation where the MACD line does not conform to the price movement, e.g. a price low is not accompanied by a low of the MACD.